Artificial Intelligence (AI) is rapidly changing the field of tax law, making it easier for businesses and governments to follow tax rules and plan strategically. AI Tax Software Solutions and AI Tax Compliance Platforms are now crucial tools for dealing with the complicated world of modern taxation.

Key points to consider:

- Why Tax Compliance Matters: It’s important for both governments and businesses to follow tax laws. This helps ensure that taxes are collected fairly and builds trust between taxpayers and authorities.

- The Need for Fraud Detection: With growing concerns about people avoiding taxes, we need strong ways to detect fraud. AI technologies can make these processes better, helping us find cases of non-compliance quickly.

The potential impact of AI on taxation is huge. By using automation, machine learning, and data analysis, tax professionals can use AI to make their work more efficient, reduce mistakes, and make better decisions.

In this article, we will explore how AI not only makes compliance processes better but also transforms strategic planning in the constantly changing digital economy. By embracing these technological advancements, we can find new ways to be efficient and secure in tax law.

The Role of AI in Tax Compliance

Tax compliance refers to the adherence of individuals and organizations to tax laws and regulations. In the digital economy, where transactions happen at lightning speed, maintaining compliance is critical. The significance of tax compliance has escalated amid increasing complexities in global tax regulations and the growing scrutiny from tax authorities.

AI plays a crucial role in improving compliance processes through automation. Traditional methods often rely heavily on manual input, leading to inefficiencies and increased error rates. By using AI Tax Compliance solutions, organizations can streamline these processes, allowing for greater accuracy and efficiency.

Key Enhancements Through AI

AI-Powered Fraud Detection Mechanisms

The evolution of tax fraud detection has been significantly influenced by the introduction of AI technologies. Traditional approaches, which relied on manual audits and basic algorithms, often fell short in identifying complex fraudulent schemes. In contrast, AI-driven fraud detection employs sophisticated machine learning models that analyze vast amounts of data in real-time, enhancing both accuracy and efficiency.

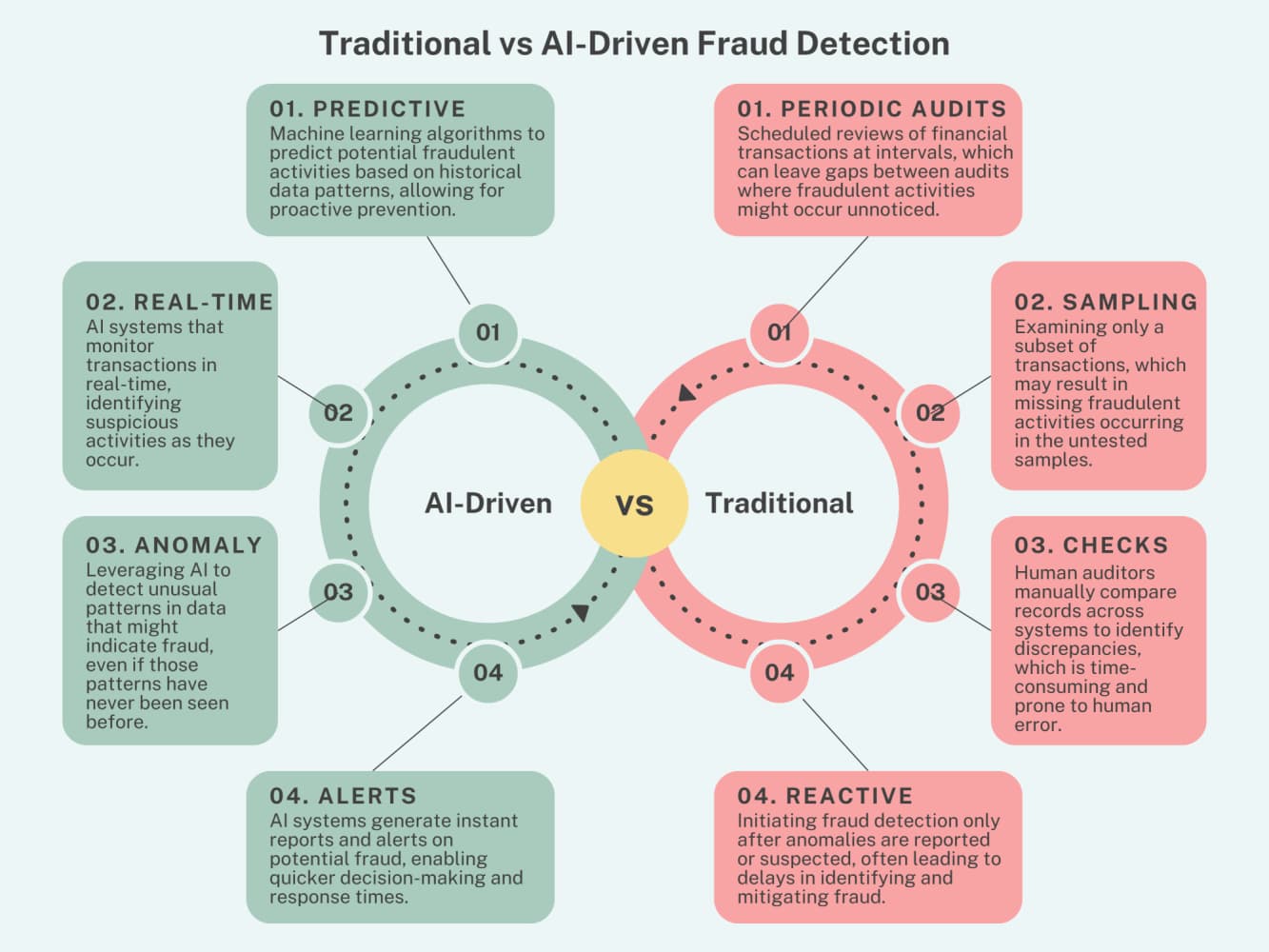

Comparing Traditional and AI-Driven Fraud Detection Approaches

The graphic below illustrates the key differences between traditional fraud detection methods and AI-driven approaches. Traditional methods rely on manual reviews and limited data analysis, which can miss subtle fraud patterns and result in sporadic audits. In contrast, AI-driven approaches offer automated, continuous monitoring with advanced pattern recognition, integrating multiple datasets for comprehensive analysis. These innovations significantly enhance the accuracy and efficiency of detecting fraudulent activities in real-time.

The Treasury’s Office of Payment Integrity has successfully implemented AI systems to recover fraudulent payments, demonstrating the effectiveness of these technologies. A recent initiative saw them recover $375 million by leveraging AI-powered tools that mitigate check fraud. This capability allows for nearly instantaneous recovery from financial institutions, significantly reducing losses due to fraudulent activities.

Real-World Applications

Several organizations have adopted AI-driven tax management and fraud detection tools:

IRS Initiatives: The IRS is utilizing machine learning techniques to enhance audit rates for high-income taxpayers and large partnerships as detailed in their recent report.

Financial Institutions: Banks are employing AI systems to monitor suspicious transactions, drastically reducing false positives while improving regulatory compliance.

Government Fraud Reduction: By leveraging AI and machine learning, government sectors are successfully reducing instances of fraud.

AI-powered tax filing tools represent a critical advancement in the fight against tax fraud. With these innovative solutions, organizations can ensure greater accuracy and security in their financial operations while navigating the complexities of the digital economy.

Challenges in Implementing AI for Fraud Detection

Implementing AI in fraud detection presents several challenges that organizations must navigate. These include:

Data Quality and Integration

Effective AI systems rely on high-quality data. Organizations often struggle with integrating disparate data sources, which can hinder the performance of AI algorithms.

Skill Gaps

The successful deployment of AI tools necessitates skilled personnel who understand machine learning and data science. A shortage of qualified professionals can impede progress.

False Positives

A significant concern in AI-driven fraud detection is the occurrence of false positives. These are legitimate transactions flagged as fraudulent, leading to unnecessary investigations and regulatory scrutiny. High rates of false positives can strain resources and damage customer relationships.

Regulatory Compliance Implications

False positives not only impact operational efficiency but also pose risks to regulatory compliance. Organizations must ensure that their fraud detection processes adhere to legal standards while managing the risk of misclassifying transactions.

Cybersecurity Risks

The digitization of tax processes raises cybersecurity concerns. As organizations adopt AI tools, they become attractive targets for cybercriminals. Safeguarding sensitive financial data requires robust security measures to prevent breaches and unauthorized access.

Addressing these challenges is essential for organizations aiming to leverage AI effectively for fraud detection. By focusing on improving data quality, bridging skill gaps, managing false positive rates, and enhancing cybersecurity measures, businesses can optimize their use of AI technologies in tackling fraud.

Strategic Planning with AI Technologies

Businesses increasingly use AI for strategic financial planning and investment strategies. The integration of AI Tax Planning tools allows organizations to automate tax strategies, enhancing both efficiency and accuracy. Here are key areas where AI can transform strategic planning:

Data Analysis

AI systems analyze large amounts of data to identify trends and opportunities, enabling informed decision-making.

Predictive Analytics

Machine learning algorithms forecast tax liabilities based on historical data, helping businesses prepare for future obligations.

Risk Assessment

AI evaluates potential risks associated with various tax strategies, allowing businesses to develop proactive approaches that minimize exposure.

Real-world applications show how effective these technologies can be. For example, companies using machine learning can optimize their investment portfolios by assessing the tax implications of different assets. This strategic foresight ensures compliance while maximizing returns.

The combination of AI in Financial Services and advanced analytics empowers organizations to create tailored solutions that adapt to changing regulations and market conditions. By using these capabilities, businesses position themselves for sustainable growth in an ever-evolving landscape.

Tax Automation Tools

Tax automation tools play a crucial role in enhancing the efficiency and accuracy of tax processes. With the integration of AI Tax Compliance technologies, businesses are experiencing transformative changes in their tax management practices.

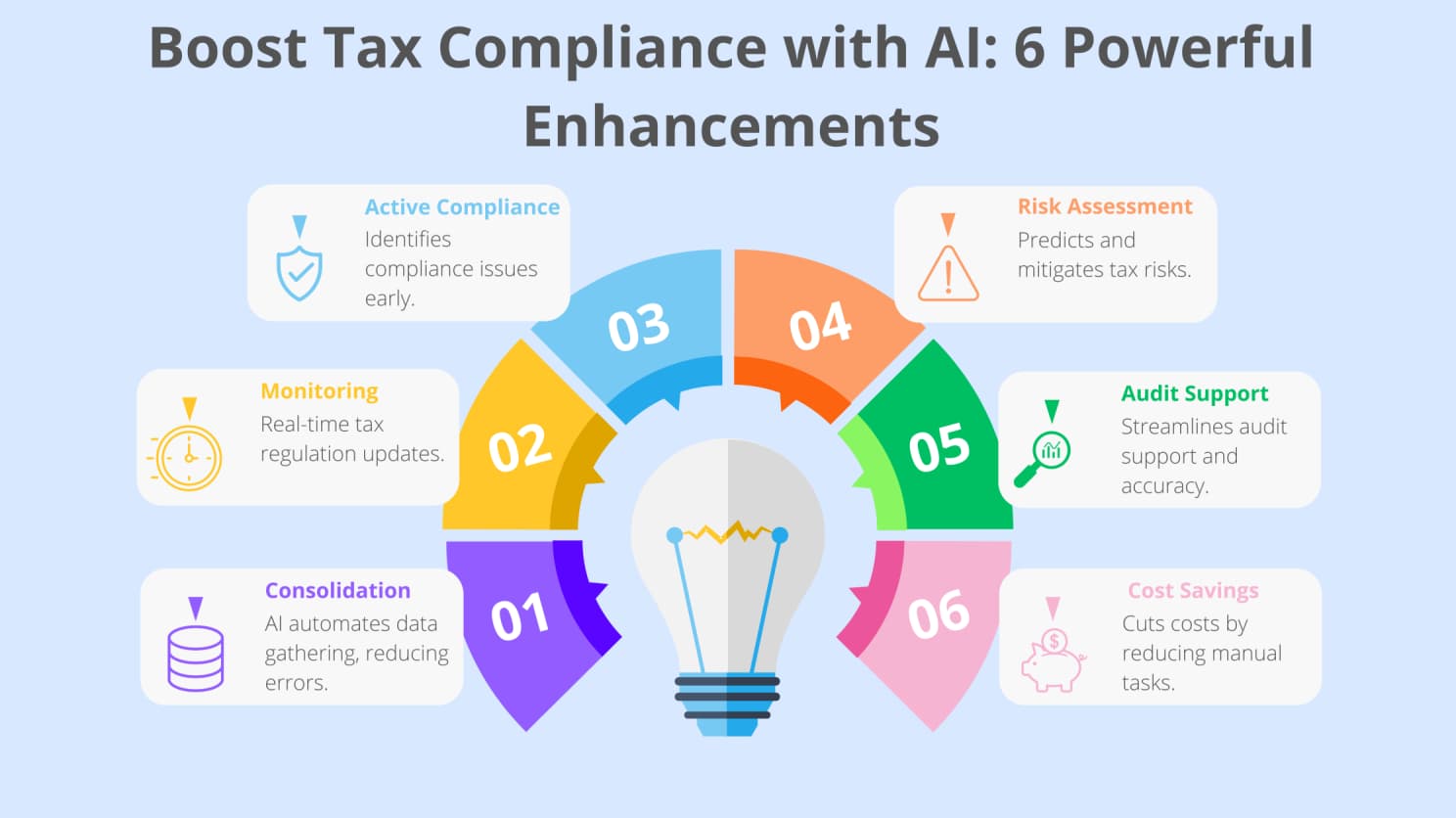

The graphic illustrates how AI significantly enhances tax compliance through automation and advanced data processing. By streamlining data consolidation, real-time regulation monitoring, and proactive compliance, AI helps mitigate risks and support audits more efficiently, ultimately leading to cost savings. This visual representation highlights the transformative impact of AI on making tax processes more accurate and efficient.

Here are some additional key benefits of using tax automation tools:

Streamlining Tax Filing Processes: Automated tax filing tools simplify the submission of tax returns, reducing manual effort and minimizing errors.

AI-Driven Compliance Checks: These tools utilize machine learning algorithms to ensure compliance with ever-changing regulations – Enhanced Risk Management Capabilities. Continuous monitoring helps identify potential issues before they escalate.

Cost Reduction Through Automation: Automating repetitive tasks lowers operational costs. This allows organizations to allocate resources more effectively while focusing on strategic initiatives.

Real-Time Tax Reporting: Instant access to tax data enables timely decision-making. Businesses can adjust strategies based on real-time insights, ensuring compliance and optimizing cash flow.

Customizable Solutions for Businesses: Many digital tax solutions offer tailored features suited to specific business needs. Customization enhances usability and ensures that tools align with organizational objectives.

Improved Audit Readiness: Automation aids in maintaining complete and accurate records, making it easier to prepare for audits. Organizations can respond promptly to inquiries from regulatory bodies. AI enhances accuracy in data analysis and reporting by processing large amounts of information quickly. This capability allows businesses to identify discrepancies and ensure that their filings are correct.

Scalability and Flexibility: As businesses grow, tax automation tools can seamlessly scale to meet increasing demands without compromising performance.

Security and Data Protection: Robust security measures protect sensitive financial information from breaches. This is essential for maintaining trust with stakeholders.

Integration with Existing Systems: Effective tax management tools integrate smoothly with current software solutions, facilitating a cohesive workflow across departments.

Adopting AI-powered tax tools fosters greater efficiency and accuracy within corporate tax automation practices, ultimately leading to enhanced operational performance.

Future Trends in AI and Taxation

The world of taxation is changing quickly because of TaxTech innovations that use advanced technologies. Here are some key trends to watch for:

Enhanced Digital Taxation Tools

Automated systems are becoming increasingly sophisticated, allowing real-time adjustments based on regulatory changes. This adaptability ensures compliance even as tax laws evolve.

Predictive Analytics

Advanced AI algorithms analyze vast datasets to forecast compliance risks and identify potential areas for audit focus. Such proactive measures enable organizations to be one step ahead, minimizing risks associated with non-compliance.

Integration of Blockchain Technology

The combination of blockchain with AI offers a secure method for tracking transactions, leading to greater transparency and accountability in the tax system.

Predictions suggest that the financial sector will embrace these advancements, resulting in:

1. A shift towards data-driven decision-making, enabling firms to tailor their strategies based on accurate insights derived from AI analysis. 2. Increased collaboration between technology providers and tax authorities, streamlining processes and enhancing efficiency across the board.

As these technologies continue to mature, the future of tax law will likely reflect a more integrated approach where compliance and strategic planning are seamlessly aligned through innovative digital solutions.

Conclusion: Embracing the Future of Tax Law with AI Technologies

AI and machine learning are transforming tax law in profound ways. These technologies are not only improving compliance processes and fraud detection but also reshaping how organizations strategize their tax-related decisions.

Key Transformations in Tax Law

Enhanced Compliance Processes

Automated Reporting: AI-driven systems can generate accurate tax reports with minimal human intervention, reducing the margin for error.

Real-Time Monitoring: Continuous tracking of transactions ensures timely compliance with ever-evolving tax regulations.

Advanced Fraud Detection

Pattern Recognition: Machine learning algorithms analyze historical data to identify unusual patterns that may indicate fraudulent activity.

Predictive Analytics: By forecasting potential areas of fraud, organizations can proactively address vulnerabilities before they escalate.

Benefits of Implementing AI/ML Systems

Improved accuracy in tax reporting: Automated systems reduce human error, leading to more precise tax filings.

Cost Efficiency: By streamlining processes, organizations can allocate resources more effectively, saving time and money.

Data-Driven Insights: Access to vast datasets enables firms to make informed decisions based on robust analytics.

Streamlined compliance processes:

1. AI technologies automate repetitive tasks, reducing the time spent on manual data entry and verification. 2. Integration with existing systems allows for real-time updates and alerts regarding compliance requirements. 3. Automated reporting tools generate accurate tax documents swiftly, ensuring timely submissions and minimizing penalties.

Enhanced fraud detection mechanisms:

1. Advanced algorithms analyze vast datasets to identify unusual patterns or anomalies that may indicate fraudulent activity. 2. Machine learning models continuously improve by learning from new data, making them more effective in detecting sophisticated fraud tactics. 3. Predictive analytics can forecast potential risks, allowing organizations to take preventive measures before issues arise.

Proactive risk management strategies:

1. Leveraging AI-driven insights enables organizations to identify vulnerabilities within their tax processes early on. 2. Continuous monitoring systems provide a dynamic approach to compliance, adapting to regulatory changes and emerging threats in real-time. 3. Scenario analysis tools simulate various risk factors, helping stakeholders make informed decisions about resource allocation and strategic planning.

It’s crucial for stakeholders to understand the significance of responsibly adopting these innovations. As technology continues to advance, embracing AI-driven solutions will not only ensure fairness in tax compliance but also empower organizations to navigate the complexities of modern taxation effectively. The future of tax law holds great potential for positive changes that can benefit everyone in the financial ecosystem. By embracing these technologies now, we can create a taxation system that is more efficient, transparent, and fair for all.